Here is the third quarterly portfolio performance update of the year.

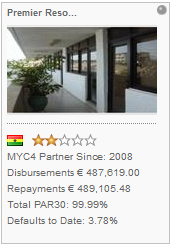

The 3rd quarter of the year marked the 3rd quarter of successive decline in disbursements. The term loan (wholesale loan) of 250,000 Euros to Premier Kenya accounted for 53% of disbursements in the quarter. The fraud situation at KEEF had a big effect on the quarter’s performance, given that KEEF had sizeable disbursements in previous quarters. Other contributory factors included the stopping of activities in two countries. We now have recruited experienced personnel so as to aggressively grow the Kenyan market and are optimistic of improved activity going forward. We have also engaged with Premier Kenya to upload the retail loans.

The portfolio quality declined sharply in the quarter. The portfolio at risk above 30 days (PAR30) closed the quarter at 54% and net defaults were at 4%. There were no defaults in the 3rd quarter. Several factors have affected portfolio quality in the quarter including termination of activity in other East African countries, fraud situation at KEEF, shrinking portfolio size among others.

From an investor point of view, the overall net return is again positive at 0.8 % on loans disbursed by the current providers* in the last five years. This represents a drop compared to previous quarters, where the return revolved around the 1.5% mark. The investor interest has been low due to competition to fund the limited opportunities that were available in the quarter

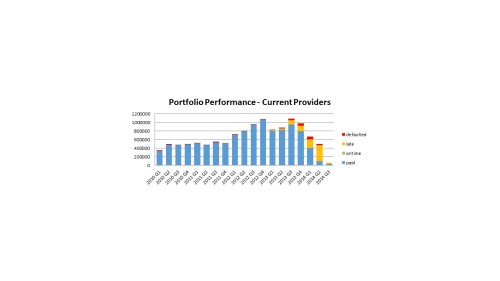

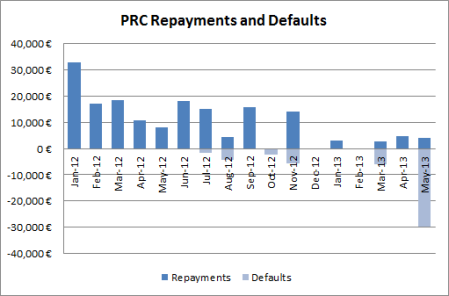

Portfolio Performance – current providers* (click to enlarge)

The Portfolio Performance Graph above shows the performance of loans disbursed since 2010 divided by quarter of disbursement. The colour blue shows funds that have already been repaid, green shows amounts that are being repaid on time, yellow indicates the balances on loans that are currently more than 30 days late, while red shows the net defaulted principal (i.e. defaulted principal less recoveries).

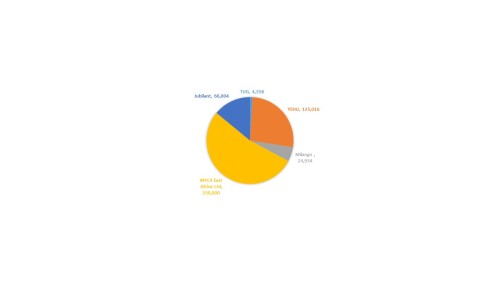

The disbursements was distributed through 5 providers, all in Kenya; except a few from Tujijenge Uganda that had been funded close to their upload deadline of 30th June. The wholesale loan of 250,000 Euro to Premier Kenya accounted for 53% of the disbursements in the quarter – being further testament of subdued activity in the quarter. The other portfolio was distributed among Yehu (27%), Jubilant (14%), Milango (5%) and Tujijenge Uganda (1%).

The distribution of the funds can be seen in the graph below.

Disbursements in € per provider in Q3 2013

(click to enlarge)

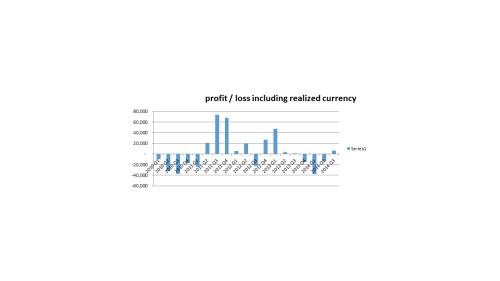

There were changes in terms of the profit and loss. Loans disbursed between Q2 2011 and Q4 2011 have experienced forex gain. 2012 were further affected by currency losses, but the overall net result of 13 of the last 14 quarters – the exception still being Q3 2012 – continues to be positive seeing as interest earned covers losses on currency (see graphs below). There have been significant defaults in the month of November 2014, which is reflecting on Q3 data (given that production of the Q3 report has been delayed, the status of defaulted loans do not represent the status as at end of Q3).

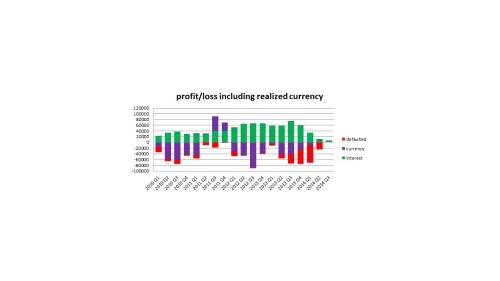

Profit & Loss – current providers* (click to enlarge)

Net profit & loss (sum of interest, defaults less recoveries, and currency gains/losses) – current providers* (click to enlarge)

The Profit & Loss graphs above show the current result on loans disbursed since 2010 divided by quarter of disbursement. In the first graph, the colour green shows the earned interest, the red indicates the net defaults (i.e. defaulted principal less recoveries), and the purple shows the net realised currency gains or losses. The second graph shows the same figures as a net sum to give an easy overview quarter by quarter.

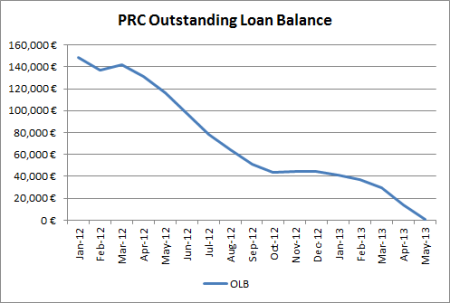

The total MYC4 portfolio closed the quarter with an outstanding loan balance (OLB) of €1.96 million in 4,593 active loans. This is an increase from the previous quarter’s €1.79 million. Around 85% of the portfolio is concentrated in Kenya where KEEF is the largest provider; 9% is held in Uganda; and with 9% in Tanzania.

Remember that you can always monitor the development and performance of the portfolio in real-time by following this link: MYC4 Portfolio