I got introduced to MYC4 in September 2011, whilst managing a donor-funded project in East Africa and looking for social investors to support a network of small, but freshly trained microfinance institutions (MFIs) serving local entrepreneurs. Eric, MYC4’s Africa Director, immediately considered the MFIs proposed for due diligence despite their small size, as opposed to most investors contacted for the same purpose. Half a year later, three MFIs had signed up with MYC4 and three more were being considered for funding. Encouraged by the positive synergies engaged between MYC4 and our partners, I also reached out to their philanthropic peers Kiva and Babyloan. Kiva soon teamed up with a Tanzanian MFI and Babyloan sent their Head of Operations to Nairobi in order to get introduced to our partner’s network.

Noticing the successful match between our small MFIs and online lending platforms, our donor became eager to understand the institutional setups, lending mechanisms and risk management frameworks allowing such flexibility. As I had already spent hours asking Eric about every nook and cranny behind the MYC4 platform, I went on with Kiva and Babyloan in order to compile the required information in a single, investor-oriented document. Noticing a twist in the fact that, due to their small size, MFIs serving niches of population escaped the bigger investor’s nets while the bigger investors sought to develop microfinance at the grassroots level, my second objective was to introduce online lending platforms as suited intermediaries to fulfil donor’s investment strategies.

You might not have the courage to read a fifty-one pages study and I cannot quite share the document yet so we’re even, but let me underline some key elements that any type and size of donor should know about when considering social investments.

Online lending platforms usually give a chance to smaller and riskier MFIs because they have developed adequate tools to manage related risks. Not because they are inexperienced. Take Kiva: experimental partnerships can get started with no due diligence at all. How can this be? Kiva sets a cap of 2% of their portfolio for such partnership types and lenders are free to choose whether or not to support borrowers in that setup. MYC4 has, over time, collaborated with more MFIs than Babyloan because of its performance monitoring tools, developed to allow the real-time overview of MFI’s portfolio at risk (PAR) and thus quick adjustments of funding caps based on actual risks. Babyloan compensates its “less flexible” monitoring tools with strict MFI selection criteria, and also shows excellent portfolio quality levels.

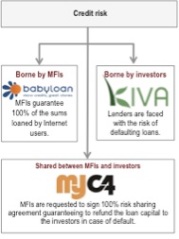

Except from bankruptcy cases, investors are guaranteed to recover capital on defaulting loans with MYC4 and Babyloan. Since February 2012, MYC4 requests its partners to cover 100% of investor’s losses through a “risk guarantee“ agreement where 20% of the funds received are saved as collateral, used to pay investors in case of default. As set in the terms and conditions of use, Babyloan’s field partners are committed to covering any losses that may occur from a loan beneficiary, and was never faced with a case of institutional default since its inception in February 2008.

African entrepreneurs bear lower interest rates for loans funded through MYC4 than for similar loan amounts received from MFIs directly, with a difference ranging from 2 to 39 points in value. This could be assessed by comparing loan product pricings on MYC4 with similar products offered in the MFI’s business as usual and featured in comparable (APR) terms on the Microfinance Transparency platform. Together with the high visibility given to MFIs opting for online funding solutions, the transparent pricing mechanisms in place at MYC4 can explain the “social premium” of the products proposed by MFIs online, as opposed to those proposed within their businesses as usual. Who said that MYC4 was less social than its philanthropic peers?